Have you ever become worried that if your car gets repossessed? It can either be a real nightmare like you are facing financial problems and have not been able to make the due car loan too many payments on time.

If the default occurs how to park your car to avoid repo process by the repo agent is crucial to explain. Repossession of the default car can be controlled by reducing the risk of repossession by using some factual tricks and also formal legal proceedings.

In this article, we will discuss practical and effective strategies to help you avoid the repossession of the vehicle from the clutches of the agents deputed to recover the repossessed vehicle on account of payment delays or other violations of the terms of the financing arrangements.

Table of Contents

- What is repossession of a Car: How and why it is done?

- Significance of ‘parking your car in safe place to avoid repo'

- Is there any Time Limit For Repo process of the Vehicle?

- When chances of repossession of your car by Repo Company are higher?

- What are possible solutions to avoid repossession of your car: -

- What repossession agents are not allowed to do?

- Steps to avoid repossession of your car

- Conclusion

- FREQUENTLY ASKED QUESTIONS

- Can changing the Parking location frequently help Preventing Repossession?

- Can a repo man move another car to get to yours in Florida?

- Can one hide a car from being repossessed?

- Can repo agents knock on the door?

- What are the repo laws in California?

- What Is the Best solution to avoid repossession of the car?

What is repossession of a Car: How and why it is done?

It is the legal process in which the car is repossessed and returned to the lender due to the failure of due payments on your part in violation of the terms of the financing agreement.

Law offers a couple of rights to the lenders to get their car back in cases of defaults on the borrowers’ part, seize and sell that car repossessed by them to recover the outstanding claim with or without interest rates.

However, if the received sum of the selling price appears to be more than the lenders' entitlement, the excess amount may be “remitted to the borrower”.

Similar Content: How to Find Mugshot

Significance of ‘parking your car in safe place to avoid repo'

If violation of the car loan payment occurs; the event of repossession of the cars gets into work and the rights of the lenders become obvious in this regard. There are no absolute rules to get the car repossessed on account of delay in the car payment of due sums.

Terms of the questioned agreement play a vital role in whether the repossession of the car is possible or not. If the terms of the agreement don’t authorize the lender to own car, they could only bring claims for the recovery of money/ sale consideration received against private sale or public sale.

The rights of the creditors to gain repossession of the vehicles due to non-payment are held under the law of equity to restore the position of the lender, where he stood before lending the vehicle to the borrower.

Therefore, ample focus is devised on articulating the terms of the lending agreement in a written notice to ensure the efficient rights of repossession lying with the lender as against the borrower.

Is there any Time Limit For Repo process of the Vehicle?

In most cases, a period of 30 days is set as per payment plan, whereafter the process for car repossession can be initiated. Nevertheless, the question of entitlement to the repossession of the vehicle largely depends on the terms of the agreement specifying default in car payments.

However, the recourse to repossession is sighted as a deferred model to enable the borrower to pay back the dues by resuming the monthly payment plan.

It is proposed to interact with the creditor as quickly as possible and communicate with him the hardship followed by settling a modified plan of payment with mutual consent of the parties in order to escape from the legal course of repossession of the cars.

When chances of repossession of your car by Repo Company are higher?

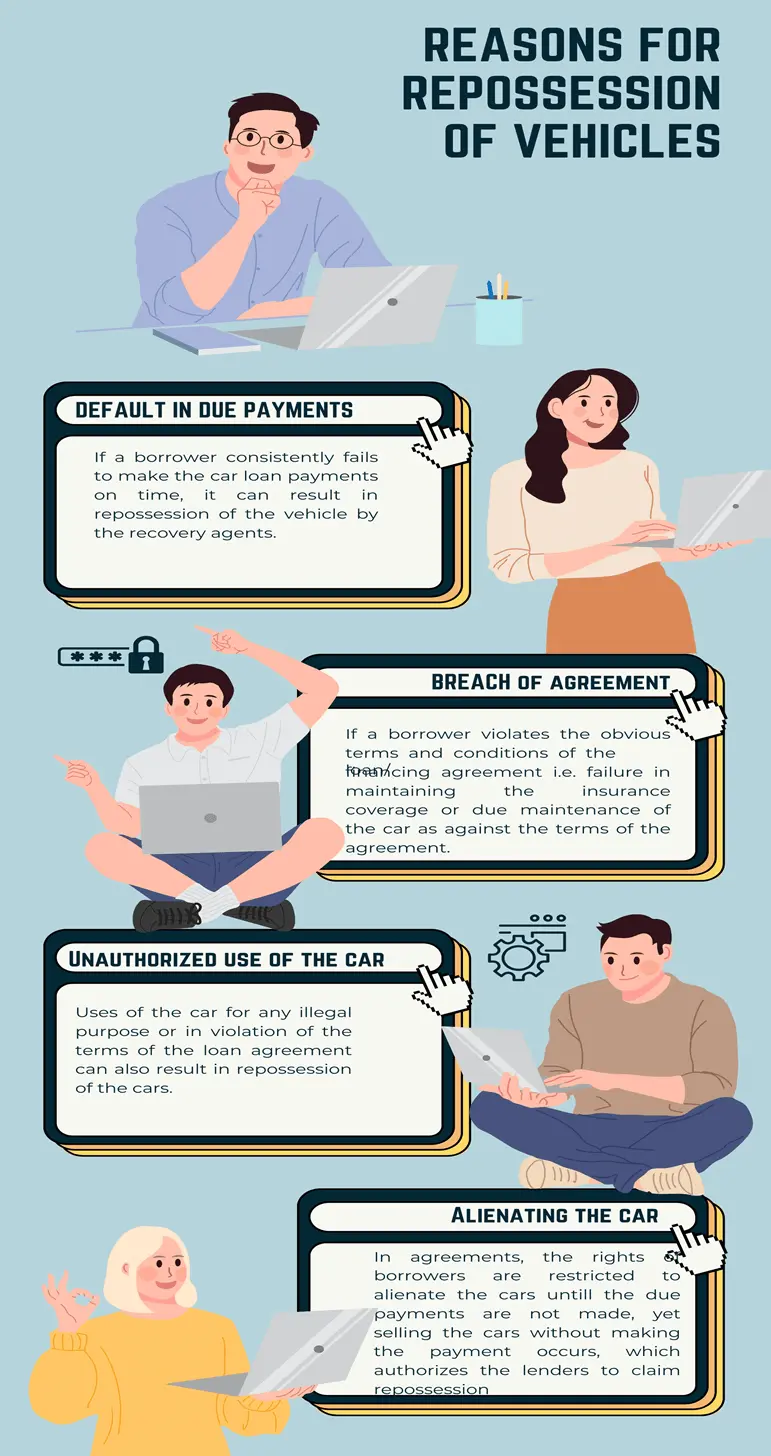

As discussed, the terms of the questioned agreement are crucial to deciding the possibility of repossession of the car by the defaulted borrower. Yet, there are certain grounds for the repossession of the cars by the lenders. A few of the key reasons are as follows: -

What are possible solutions to avoid repossession of your car: -

There are several ways and strategies, which can be followed to avoid repossession of a car against any kind of the default. The means are adopted to avoid the legal process of reoccupying the car due to default on the part of the borrower or possessor of the car.

In order to minimize the risk and to avoid car repossession, people used to devise formulas so they can defer the return of the cars by exercising any personal effort or seeking any kind of injunctive court order on one pretext or the other.

However, the means of avoiding repossession process can either be temporary import or others those leading to permanent solution. For convenience purposes, the means of avoiding the car repossession have been divided in two i.e. Informal Measures and Formal Measures.

Informal Measures to avoid car repossession

These measures refer to that legal action of the individuals taken at his own course to avoid the repossession of the vehicles on account of his default in the payment. Following are key measures: -

Park your car in secure places to avoid car repossession

Parking the cars in appropriate places can minimize the risk of car repossession by the repossession agent working on behalf of the lenders. In case, the cars are parked on high risk areas where the force of law is remotely applied the chances of the repossession increase.

Therefore, it has been proposed that the cars vulnerable for the repossession needed to be parked in areas where the lightening is obvious and the systems of surveillance have also been installed.

Likewise, paid and/ or covered parking are also preferred places of parking for the vehicles. In such like areas, the cars are returned to only those in possession of the ticket issued for the return of the cars or to those who are working as obvious attorney.

Furthermore, it becomes difficult for repo man to find and recover the cars, or recovery towing fees on account of tow truck, on the basis of credit report as they would have no access to the paid areas or those under the covered areas.

Remove the GPS tracker and license plate of the car to hide the current location

If your car has a GPS tracker and license plate, it will be safer enough to remove the tracker with the help of some technician/ professional so the repo man cannot find the secure location of the car to proceed with the process of repossession.

Tracing the installation of the tracker and removing it could consume some effort and time but it is very effective to escape from the sight of the repo man.

Although, removal of the tracker and license plate makes the car vulnerable for the crimes like theft and extortion yet by parking the cars in the paid slots and secure location can make it safe. Whatever you do, wherever you park your car, stay up to date about it.

Apply random parking patterns to become unpredicted

Parking the cars at different spots in nearby areas i.e. driveway, garage, and street parking can also make it hard for the repo man to locate the car and reoccupy.

Such rotation patterns seem cumbersome to apply but these are considered valuable means to avoid the deprivation from the valuable items.

It must be considered that repo agents have multiple tasks to offer and the entire team cannot be engaged to gauge and repossess a single car.

However, it is again a temporary solution to defer the reoccupation of the car to the lenders, thus, meanwhile, a roadmap must be devised to satisfy claim of the lender to continue with the uninterrupted possession.

Involve a Friend to Continue with Possession

You can further hand over the car to a friend or some other person to avoid repossession of the car by the repo agents. If the agents have acquired your location to reach at your place and to reoccupy the car, the efforts would fail as the car won’t be around you.

If the friend has taken over possession of the car for your benefit the car can be hidden under his garage or the place provided to him for parking of the car. At the same time, you need to keep an eye on acts of the neighbor, which could prejudice your rights qua the car in his possession.

Formal Measures to Avoid Repossession of Your Car

These measures are taken under a legal cover by involving third parties so to help them in resolving the outstanding issues and come up with valuable solution agreeable to either of the parties. Some of the running examples of the formal measures are as follows: -

Make due Payment to avoid repo

This is the most appropriate legal course to have permanently solved the issues of repossession of the car by the repo man. In case the due payments are made on time as per agreed schedule to Repossession Company till the satisfaction of the entire claim, the risk of repossession ends.

However, if you make the late payments, instead hiding yourself and the car from the sight of the repo man, it could work to set a meeting with the repo company and negotiate for the immediate partial car payment followed by another installment.

In addition to above options, a fresh understanding describing the rescheduling of the late payment could also guarantee the continuity of your possession over the car for some longer period.

Alienate the car to third party to avoid repossession of your car

It is inappropriate to sell the car just to avoid repossession of the car and also to escape from the financial liability accruing towards the lender. However, it would free you from the repossession company.

In this way, you can effectively create rights of third parties and the legal course of repossession would initially fail, yet the liability to make the missed payments would continue.

In case the terms of the financial facility or the lending agreement curtailed rights of the borrower to alienate the car, the selling of the car or disposing of the same in any other manner would not be effective against the rights of the lender; thus the agreement would become nullity in the eyes of state law.

The legal maxim ‘no one can transfer a better title’ postulates the one under clog on non-alienation cannot transfer or sell the car in violation of the agreement.

Negotiate with Lender on Settlement Options

It is worth mentioning that even if you become successful against the repo man and the cars cannot be repossessed by repo company, the financial liability would continue to persist rather with the passing of each day, it will increase.

The primary concern of the lender to get his amount back, the acts of repossession would incur him expense and delivery of the car with depreciated value, and therefore it is always workable to sit together and discuss the "financial difficulties" and decide a road for making of further payment preferably in instalments.

Where many stakeholders get involved in the process of repossession or recovery, the chances of settlement shrinks to the minimum level.

File a Bankruptcy Suit/ Petition

The legal course of declaration as bankrupt/ insolvent is also considered an effective means to retain the car even if you have committed gross violation to the terms of financing agreement.

In a written notice add how many car payments you have made along with the missed and remaining payments.

The law of the land provides a negotiating plan for the payment of debts by the bankrupts with such flexibility that suites to his financial difficulties. During the proposed period of payment, the possession of the car is retained by the borrower.

What repossession agents are not allowed to do?

- A repo man cannot get you arrested on account of default in payment as the matter pertains a civil liability and custody and the jail are not involved.

- A repo man cannot extend any threat of violence to you. Remember he is a man of repossession company and is doing his job of the default vehicle but he cannot take law in his hands.

- A rep man is not allowed to trespass your private property without your consent to get possession of the park vehicle.

- A repo agent is first required to report the police about the suspicious activity; failing which he can be proceeded against for the charges of violation or theft.

- A repo man has “no authority to touch you or your private property” or make of force on you to get you out of your car no matter the payment of the car is due.

Steps to avoid repossession of your car

Taking of suspicious activity could help in retaining the possession of the car for longer period in time and defeat the efforts of repo man to reoccupy the cars. These have been enumerated below:- -

- Always choose safe parking spots be that paid or at private property.

- Uses and “installation of anti-theft devices” can also keep you longer in possession of the cars. Various types of car alarms, wheel locks and GPS tracking have been deployed in the market to deter repossession agent.

- Maintain regular car payments and avoid defaults to perpetuate the possession over the car and also follow the rules and regulations in place for the running and maintenance of the repossessed vehicle.

- Last, but not the least, one could also resort to options providing financial assistance to help out in making of the payment on time like the procuring of the loan balance, easy cash or credit card facilities including those issued on account of credit union.

Conclusion

We have sufficiently discussed the means and strategies to avoid the legal course of repossession of the cars on account of some default on our part. Yet all these means may afford merely some time to retain the possession but cannot avoid the ultimate financial liability of the borrower standing for the creditor.

The strategies referred in the article could either provide “a temporary solution against the repossessions” or lead to the legal courses, which facilitate the borrower to delay the making of missed payments but the same are not sufficient to nil the liability from your shoulders.

In a nutshell, interacting the lender for negotiating a fresh understanding for the payment in installments is the key to success for delaying the repossession and likewise committing to restore the financial position of the lender.

FREQUENTLY ASKED QUESTIONS

Can changing the Parking location frequently help Preventing Repossession?

While changing the parking spots occasionally makes it harder for repossession agent to locate the car and repossess, however, it is not a foolproof approach. The agents can still exert labor to locate it for repossession.

Can a repo man move another car to get to yours in Florida?

No, he can’t. He can use another car to trace yours but cannot move your car by using another car without your permission. However, it largely depends on the law of the land how it deals the issues of repossession.

It can be locked in the garage or some paid public parking, the creditor will not be allowed to get possession of car without your consent to ensure safe custody of your car. However, if the state law has given creditor some rights to repossess, then it can be done.

Can repo agents knock on the door?

As a creditor or his agent; yes, he can come and request on behalf of the repossession company for repossession of your car. However, he is not allowed to do it forcefully without your consent rather he is required to follow the orders of Repossession Company.

What are the repo laws in California?

The state laws of California are strict with the creditor. Upon a day delay in payment of the amount the creditor becomes entitled to repossess the car. However, it can be restored after payment of dues, late payment and repossession charges etc.

What Is the Best solution to avoid repossession of the car?

Keep in touch with the lender and continue with the partial payments to accommodate the lender. Conversely, the borrower will also be at lease to work with his full potential to make the payments as per fresh payment plan.