LLC, Limited Liability Company, is a business entity to limit the liabilities for business debts and obligations. You cannot assume the total estimate of opening an LLC in any state because of the varying fees and the varying states’ laws.

The owners of the LLC will have less and limited liabilities as that of the corporations and other business organizations. How much does it cost to start an LLC, what is an LLC, an LLC cost by state etc. are the challenging questions people often face. This article addresses all the costs and expenses of an LLC.

Table of Contents

What is an LLC?

It is named so on account of the interesting fact that it is mixture, a hybrid system of partnership and corporation. Forming an LLC entails various considerations and costs. Initial expenses such as franchise fees, state fees, and filing articles with the appropriate authorities are common.

Choosing an LLC name, ensuring it's unique and not a fictitious business name, is crucial for legal compliance and branding. Once established, ongoing costs like franchise taxes and filing annual reports maintain the LLC's good standing.

Choosing an LLC name, ensuring it's unique and not a fictitious business name, is crucial for legal compliance and branding. Once established, ongoing costs like franchise taxes and filing annual reports maintain the LLC's good standing.

Liability protection is a key advantage, shielding personal assets from business liabilities. Additionally, having a physical address is often necessary for legal and tax purposes. While the total cost of forming and maintaining an LLC varies significantly depending on jurisdiction and services required.

Related Article:How To Search Storefronts On Amazon App

Protection Lies in the LLC

The LLC enjoy the luxuries of both, the owners of the LLC will have less and limited liabilities as that of the corporations and other business organizations. It also shields the personal; assets of the owner if it unfortunately meet any financial hardships.

The best thing in the LLC is protection from the double taxation and the profits and losses pass through to the owners. You can just take into consideration the fees of different processes and then can calculate the rough estimate that may range from $150 to $4000.

It is a hybrid system of partnership and corporation. The owners have options of Manager Managed Vs Member Managed; if either they want to manage or to hire some managers.

Two Major Types of an LLC?

Before going to in-depth of the costs of an LLC it would be preferable to know the major types. There are following two major types of LLC: -

a). Manager-managed LLC

The manager managed LLC, an LLC managed by the managers means that all the arrangements and decisions are done by the managers who are the employees of the company and get salaries along with other protocols.

The owners high some skillful employees or vote for the most knowledgeable and the intelligent one who will look after all the business affairs. They will manage the accounts, buy and sale the real estate, assets, vehicles and other shares.

They will also hire employees and manage the debts of the business. The owners and the investors will be the passive and the silent members who would give the authority to the managers.

b). Member-managed LLC

An LLC managed by members, it is the most common and widely used LLC type. If you do not show the LLC managements on the LLC documents to the world then your company by default is the member managed.

All the owners, investors and the shareholders are the members of LLC and all have the rights to decide the agreements, contracts, accounts, buying and selling and the future of the company.

If you are interested in working within your LLC along with the employees and are skillful to decide all the ups and downs then it would be a great choice for your LLC.

Costs Involved in Both Types

The answer of the question depends on the type of your LLC, if your LLC is member-managed, the LLC cost by state will be relatively lower because the members who are also the owners will run the business and the establishing steps.

In the opposite case the costs will be higher because you will have to hire managers, lawyers and other service providers to run the business and perform the other functions.

How Much Does It Cost To Start An LLC?

You cannot assume the total estimate of opening an LLC in any state because of the varying fees and the varying states’ laws.

You can just take into consideration the fees of different processes and then can calculate the rough estimate that may range from $150 to $4000. For instance the filing fees ranges from $35 to $500, operating fees ranges from $0 to $600, you will always need to publish the LLC certificate which casts from $40 to $1,500.

You can just take into consideration the fees of different processes and then can calculate the rough estimate that may range from $150 to $4000. For instance the filing fees ranges from $35 to $500, operating fees ranges from $0 to $600, you will always need to publish the LLC certificate which casts from $40 to $1,500.

In addition to it, there is some other additional charges like that of DBA which are from $10 to $100, you may also need a registered agent which charges from $0 to $300.

Without business license you cannot open an LLC that needs $50 to $1000 including other taxes. The annual report fees if included the taxes will be from $10 to $800. So the LLC costs by state are in between $150 and $4000.

An LLC Cost by State

There are two types of costs that are mandatory and highly required for an LLC. The first one, which is also known as the startup phase, in the very beginning you will have to file the fee and other necessary documents, make agreements which be the guide in the operations, and many more things.

The second one is the maintenance fee in which you will have to pay the taxes, renew the name and to pay the annual report fee.

The second one is the maintenance fee in which you will have to pay the taxes, renew the name and to pay the annual report fee.

LLC Costs: Startup

There are many processes involved in the very beginning and after the opening of an LLC. All of them are important and useful for the establishment and the after fair, paperwork, financial and social growth on an LLC.

Forming a limited liability company (LLC) incurs various costs, including filing fees and state filing fees, typically ranging from a few hundred to over a thousand dollars. Business license renewal fees and ongoing costs such as registered agent services contribute to the total expense.

Additionally, LLC formation services offer convenience but come with their own fees. Franchise taxes, annual reports, and operating agreements are essential elements in maintaining compliance, each adding to the overall cost.

While the exact amount varies depending on jurisdiction and services required, it's crucial to budget for these expenses to ensure a smooth and legally compliant LLC formation process.

A). Filing Fees of LLC

The very first process involved in the very beginning of an LLC is the filing of the essential documents along with the filing fee.

To file an article of organization is the very basic thing and will be done with extra care, you can do it by yourself. If you are not much professional and think of some mistakes may be committed while filing, then you are directed to find a service provider that can do it for you. The service provider may charge up to $50 and the state may also get its fees.

To file an article of organization is the very basic thing and will be done with extra care, you can do it by yourself. If you are not much professional and think of some mistakes may be committed while filing, then you are directed to find a service provider that can do it for you. The service provider may charge up to $50 and the state may also get its fees.

You think in your mind that what will be the need of hiring a service provider? Or why you should hire a lawyer for it? They are necessary in order to file an article of organization without any mistake that is possible and is expected of you.

B). Operating Agreement of LLC

The next process required for LLC after the filing fees is the operating agreement. You may ask the question of the fees of operating agreement along with cost to start an LLC.

The fee will be none if you can yourself create your agreement for your organization but may cost from $50 up to $200 to hire service providers or lawyer. An operating agreement will guide your LLC to run and will highlights the role and contributions of the owners or members in the case of member managed LLC.

The fee will be none if you can yourself create your agreement for your organization but may cost from $50 up to $200 to hire service providers or lawyer. An operating agreement will guide your LLC to run and will highlights the role and contributions of the owners or members in the case of member managed LLC.

C). Publication of Notice

The third factor is the publication of notice in the newspaper about your LLC that would be necessary and is a key step in establishing an LLC.

An LLC would publish a notice in one daily newspaper and one in weekly newspaper. The cost of publication may vary from state to state and is not specific on account of the states’ laws. An LLC cost by state is highly dependable on a state.

An LLC would publish a notice in one daily newspaper and one in weekly newspaper. The cost of publication may vary from state to state and is not specific on account of the states’ laws. An LLC cost by state is highly dependable on a state.

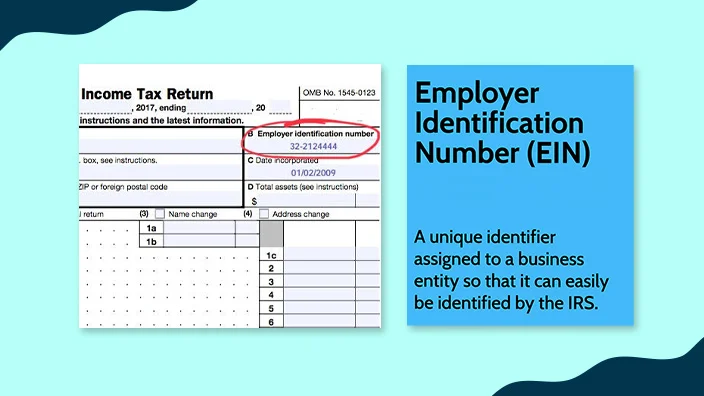

D). EIN Application

EIN, an Employer Identification Number, is a number comprised on nine digits that will be assigned by the states to the business and other organizations for tax purposes.

Applying EIN is not a tough job and is not a complicated question like how much does it cost to start an LLC. The process is quite simple, you can just apply only for the EIN or can get through fax or mail with the Form SS-4 and all the basic details. The online way is the easiest and quickest method.

Applying EIN is not a tough job and is not a complicated question like how much does it cost to start an LLC. The process is quite simple, you can just apply only for the EIN or can get through fax or mail with the Form SS-4 and all the basic details. The online way is the easiest and quickest method.

E). DBA (Doing business as) Fees

This one is not applicable for all and not used by all as well but it does not necessarily mean that it is not mandatory. Doing business as is second name used for trade and is different from an LLC’s legal name.

DBA may cost $10 which is the minimum and may exceed up to $100 but that depends on the policies and laws of states. Many claim that the DBA fees may include the filing fee, publication fee and one or more.

LLC Costs: Maintenance

After the filing fee, operating agreement, publication of the notice in newspapers about your LLC and getting the EIN, you will take in to account the other additional costs, the maintenance that are only one time except the monthly and annual taxes.

The maintenance costs include the taxes, registered agents, business license fee, annual report fee and LLC name reservation.

The maintenance costs include the taxes, registered agents, business license fee, annual report fee and LLC name reservation.

a). Taxes

An LLC may be subjected to taxes but unlike other business organizations. It is indirectly subjected to taxes which means that taxes are not directly collected from LLCs by the federal government but rather form the profits of the owners and the members of the LLCs as a pass through income.

There are still some states that collect taxes directly from the LLCs, for instances, take the examples of Delaware and California. The former has the franchise tax up to $300 while the latter has annual franchise tax $800, which the minimum.

b). Registered agents

The second one in the maintenance cost is the registered agents, which costs from $0 to $300. It is the source of contact and bridges the connections between state and LLC.

The registered agent can be any adult but the requirement is that he/she may be the resident of the state in which the LLC is registered.

The registered agent can be any adult but the requirement is that he/she may be the resident of the state in which the LLC is registered.

The duties of the registered agent may include accepting the lawsuits and the other legal documents via mails or any other sources and must ensure his/her availability in the business hours.

If you cannot be the registered agent yourself then you can contact service providers to do the job for you while charging handsome pennies.

c). Business license fee

Without business license you cannot assume the LLC cost by state, without it you cannot even run a business because license is the key of the business engine. Its cost may vary from state to state and from location to location.

In addition to these factors, there are more that affect the cost of business license i.e. type of business, duration of the license, revenue of LLC and countess more.

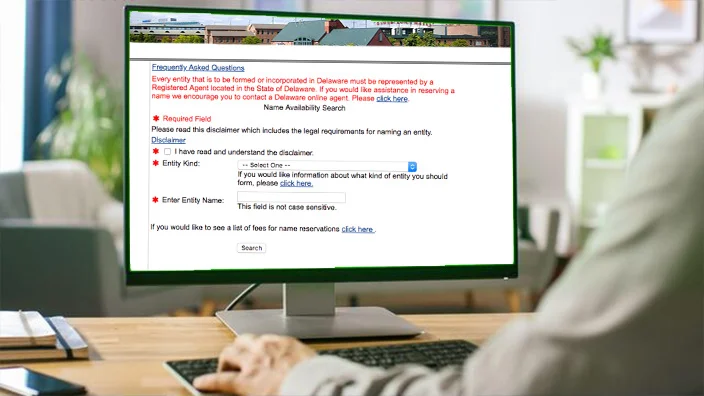

d). LLC Name Reservation

It is must for an LLC to select a name before filing an article of organization. Without any name you cannot file anything officially, so this is the first and foremost necessity to name your LLC.

It is the one time process and you must pay some charges to the state, the fees ranges from $10 to $140, depends on the state and its law. The lowest fee is that of Albama while strangely Florida does not charge any penny foe the name reservation.

It is the one time process and you must pay some charges to the state, the fees ranges from $10 to $140, depends on the state and its law. The lowest fee is that of Albama while strangely Florida does not charge any penny foe the name reservation.

How much does an LLC cost in New York?

Finding the costs of an LLC in New York would compel us on recalling all the other costs that an LLC costs by state. The processes like filing fee, operating agreement, publication of the notice in newspapers about your LLC and getting the EIN and in other useful paperwork are relatively more than the other states.

New York LLC Cost

Establishing an LLC in New York is a little bit expensive than that of in other states, generally speaking, the costs may start from $200. Other charges are higher than that of other states as well.

To publish a certificate will cost $50 in New York, the annual or biennial report fee is not much, and it is just $9. To reserve a name either domestic or foreign for an LLC will cost around $20.

The cost of registered agent may range from $0 to $125 per year, to compile and prepare an article of organization it will charged around $200 in New York.

The other charges like that of agreements, EIN and other taxes highly vary from location to location, so it can be said or estimated.

How much does it cost to start an LLC in 2024?

You cannot assume the total estimate of opening an LLC in any state because of the varying fees and the varying states’ laws. It is summarily added that LLC costs vary from state to state but typically those range from $150 to $4000, including filing fees ($35 to $500), operating fees ($0 to $600), publishing fees ($40 to $1500), DBA fees ($10 to $100), registered agent fees ($0 to $300), business license fees ($50 to $1000), and annual report fees ($10 to $800) and so on.

It is summarily added that LLC costs vary from state to state but typically those range from $150 to $4000, including filing fees ($35 to $500), operating fees ($0 to $600), publishing fees ($40 to $1500), DBA fees ($10 to $100), registered agent fees ($0 to $300), business license fees ($50 to $1000), and annual report fees ($10 to $800) and so on.

Costs of Running an LLC

There are some charges which are the ongoing costs of an LLC and it cannot be denied because missing such charges may spoil the relations of an LC with state. So in order to save the legal rights of your LLC with the government and state, you must pay the ongoing costs or charges of running an LLC.

Minimum Annual LLC Taxes

While paying all the startup, maintenance and the ongoing charges you are in to the market of a state. Now in order to survive in such environment you must always take into considerations all the governments’ taxes.

Although LLC is not subjected to the direct taxes like other business organizations but still it is a sort of business under the state and it must pay the minimum annual taxes. It is also termed as Franchise Taxes or Privilege Taxes.

State will not consider the income, irrespective of the income of LLC state will charge the minimum annual tax. These kinds of taxes vary from state to state, taking the case of California, it charges the minimum of $800 per year. Other states will charge less annual minimum charges like that of Albama, Florida etc.

Annual Report Fees

Annual report is also called biennial report, periodic report or statement of information. It is often paid after a year or two with the submission of the yearly report about an LLC, it is done for the purpose of keeping on record all the details of an LLC with the state.

Annual report is also called biennial report, periodic report or statement of information. It is often paid after a year or two with the submission of the yearly report about an LLC, it is done for the purpose of keeping on record all the details of an LLC with the state.

The fee is not specific and varies according to the law and policy of a state. The annual report fee starts from $20 which is the minimum for a state and some states may also charge up to $100.

Business License Renewal Fees

One of the very first steps is getting a license for an LLC. Once you make a license for your LLC it should be renewed after every year as per state policy and the fees must also be submitted for the renewal duly.

The license may be local or of state business but it should be renewed. The renewal fee begins from $20 and some states may charge up to $100.

Speaking with an attorney

It would always be good idea to consult a business attorney because doing all the necessary things yourself before establishing an LLC would be difficult. Hire service providers and ask them to provide you all the necessary requirement and paperwork.

They will charge some pennies but will save you from every trouble. They will help you filing fee, operating agreement, publication of the notice in newspapers about your LLC and getting the EIN and in other useful paperwork.

Conclusion

LLC, Limited Liability Company, is a business entity to limit the liabilities for business debts and obligations and the article has given ample answer to the frequently asked query ‘How much does it cost to start an LLC?’

You cannot assume the total estimate of opening an LLC in any state because of the varying fees and the varying states’ laws. However, you can still take into consideration the fees of different processes and then can calculate the rough estimate that may range from $150 to $4000.

Besides one time payments as of startup fee, one willing to continue with the LLC needs to keep paying the renewal fees and make sure the incidental payments so on.

Frequently Asked Questions

How much is it to get a LLC in Florida?

The fee of filing for LLC in Florida is $125 and the annual report will cost $138. For registered agent the charges will be the same as other state, $35/year. The expedition charges in PA will be from $70 to $140. However, the total costs cannot be estimated on account of varying locations.

How long does it take to form an LLC in NY?

The costs may start from $200. Publishing a certificate will cost $50, the biennial report fee is just $9. To reserve a name for an LLC will cost around $20. The cost of registered agent; $0 to $125 per year, an article of organization will charge around $200 in New York.

How much is LLC in North Carolina?

The cost of article of organization for LLC in North Carolina is $125, the filing fee is $125 as well. For registered agent the charges will be $35/year while the annual report fee is $202. However, the total costs cannot be estimated on account of varying locations.

How much is it to start an LLC in PA?

The fee of filing for LLC in PA is $125 and to reserve a name will cost $70. For registered agent the charges will be $35/year while the annual report fee is $150. The expedition charges in PA will be from $50 to $150. However, the total costs cannot be estimated on account of varying locations.