Have you ever been subject to any legal proceedings, for instance, debt collection lawsuits? If you have, then you must know that you can throw the lawsuit away by filing a motion in court.

However, if don’t know how to go with this process, you are at the right place for guidance. Let’s dive into insights into how to get a debt lawsuit dismissed.

The study enlightens us with all the helpful information about dismissing a debt lawsuit. It shows the steps and process of filing a motion to dismiss lawsuits.

The article also adds much to the mediations and out of court settlements in the case of not involving the court. keep reading the guide.

Table of Contents

- Steps for Filing a Motion to Dismiss Lawsuits

- Dismissal of a Debt Lawsuit

- Reasons to File a Motion

- Insufficient Evidence - A Case Dismissed

- How to Get a Credit Card Lawsuit Dismissed

- Steps You Can Take to Validate the Debt

- Debt Collectors Followed the Laws?

- If Applicable, File for Bankruptcy

- Proper and on-time response

- Raise Affirmative Defenses

- Examples- Common Affirmative Defenses

- Prove the Case

- Effectively Negotiate a Debt Settlement

- Motion to Dismiss a Claim

- Sued by a Debt Collector? What to do

- Defend the Lawsuit

- Conclusion

- Frequently Asked Questions

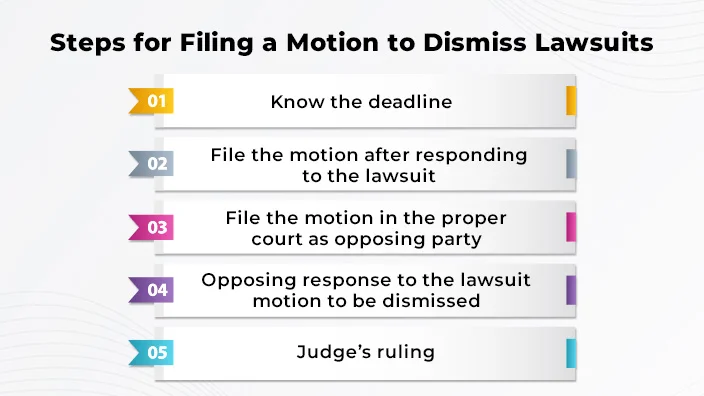

Steps for Filing a Motion to Dismiss Lawsuits

Before filing a motion to automatically dismiss a lawsuit, the key factor one must keep in mind is the time factor. You must file your lawsuit for dismissal before the deadline is over. The steps you should follow in the motion are: -

First, you can only file the motion after, not before, you respond to the lawsuit of the complainer by submitting your answers.

First, you can only file the motion after, not before, you respond to the lawsuit of the complainer by submitting your answers.

In the second step, to serve the opposing party, file the motion in the proper court.

In the third step, the opposing party can also avail the opportunity to respond to the lawsuit motion to be dismissed.

In the last step, the judge, as a final authority, will go through the motion and the response submitted by the opposing party by reviving the allegations.

Ruling by Courts

The judge will issue a ruling either in favor of the motion or against it. However, once the case of the plaintiff is dismissed with prejudice, the plaintiff will not be able to file the same motion in court again.

An Example of Lawsuit by Smith

Smith got a lawsuit from “Capital One” as he had loan debt from auto of $1,500 on being defaulted from paying.

To see if he has any chance to get the lawsuit dismissed, he checks it online and finds out that by using the “Texas Statue of Limitations” as his reason, he can go for a request to dismiss the case.

However, he first responds to the lawsuit with an answer. After that, he went to file a motion of dismissal by accusing Capital One of the debt being old and some five years old.

However, the Capital responded to the motion to be dismissed by attaching the files that show evidence against Smith.

It shows that the dates shown by Smith are miscalculated and the last payment date was 3 years prior. The judge conducted the legal proceedings and the case voluntarily ruled in the favor of Capital One.

Dismissal of a Debt Lawsuit

Making a case dismissed from the debt collection lawsuit, for instance, means your claim that the lawsuit is not valid and the case, for this reason, should not proceed.

As mentioned, you must file the motion after you have answered the question to get a chance to file a motion. Conversely, you can avail of other options even if the plaintiff’s claim is true. Some reasons for Plaintiff’s motion dismissals are: -

“Debt settlement” is the reason why the plaintiff can file a motion to dismiss the case because the settlers settle the debts and the lawsuit no longer exists.

“Lack of evidence” may be another reason for the withdrawal on behalf of the plaintiff.

“Procedural issues” like lawsuit filing in the wrong jurisdiction, etc. In addition, the plaintiff can also file a motion to dismiss while keeping in mind the “cost-benefit equation".

Reasons to File a Motion

Procedural issues, rather than merit, are the most common cause to file a motion of dismissal.

Some important reasons include “the expired statute of limitations”, the case being out of court jurisdiction, the lawsuit being filed in the wrong place, the lawsuit not being legally served, and the plaintiff's lawsuit in the name of the wrong person or party.

One of the most important common situations in which a motion of dismissal is filed back when you owe some money back to the creditor or debt collector. The landlord claims a chunk of money back.

One of the most important common situations in which a motion of dismissal is filed back when you owe some money back to the creditor or debt collector. The landlord claims a chunk of money back.

The reason why the case may not be valid, for instance, is the unavailability of the record albeit of being paid to the landlord.

The landlord may not have all the records of what you have paid to him. The burden is on you to provide him with the record and proof. So, if your documents are with you, you can file a motion to dismiss the case.

Interestingly, many people have the opinion that the motion to dismiss can only be filed on behalf of the defendant. However, the motion to dismiss the lawsuit can also be filed by the plaintiff.

In addition, if you file your answer and the plaintiff dismisses the lawsuit, after the agreement between both parties, the judge can dismiss the case.

The court has the legal right to take legal action via its own decision of dismissal after the agreement between both parties, but in this situation is “Sua Sponte” not a motion to dismiss?

Insufficient Evidence - A Case Dismissed

If there is no sufficient evidence, in criminal law, to prove that there is no crime committed, the defendant can plead with the judges to dismiss the case.

If the judge's node to the plea, the case will be closed and the defendant cannot be put on trial for the same crime.

If the judge's node to the plea, the case will be closed and the defendant cannot be put on trial for the same crime.

Most of the time, the judges observe the evidence in such a way that the favor goes to the government.

When the defendant is strong and the judges have no way other than to believe that the defendant is not guilty, then the defendant gets the favor. Usually, the defendant doesn’t go for filing a motion to dismiss in civil lawsuits.

How to Get a Credit Card Lawsuit Dismissed

Have you ended up in a stressful financial situation in which you are sued by a debt collector who is taking you to court? If yes, then you are not in any uncommon scenario as most of the time creditors, like Capital One, sue people to recover debts.

After suing by the creditors, you might seem to have no options but if you know your rights and are prepared, you can effectively strategize and avoid the lawsuit.

After being sued by a debt collector, for credit card debt, instead of becoming a victim and asking several questions, just try to get into the process of the debt.

Try to figure out whether the creditors have sued you mistakenly or not because debts are often sold multiple times.

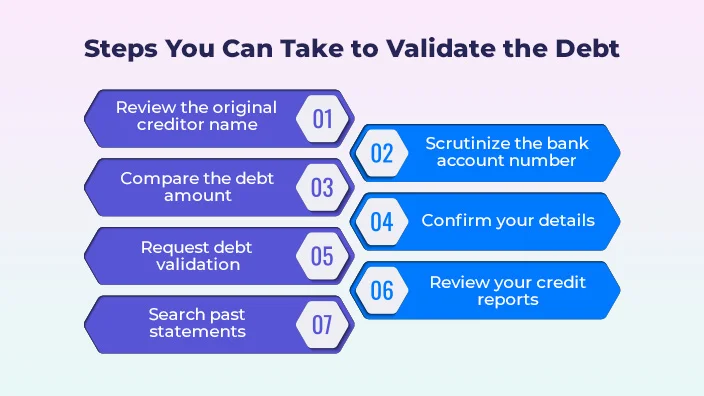

Steps You Can Take to Validate the Debt

Firstly, “review the original creditor name” by recognizing whether the bank records and company align your records.

Firstly, “review the original creditor name” by recognizing whether the bank records and company align your records.

Secondly, “scrutinize the bank account number” by matching the complaint number to the account number you had.

Thirdly, “compare the debt amount” by adding the charges and interest and see if it matches you or is foreign. If foreign, it may not be your debt.

Fourthly, “confirm your details” by double checking your personal info, name, and address.

Fifthly, “request debt validation” in written form under the Fair Debt Collection Practices Act.

Sixthly, “review your credit reports” to know whether an unknown bank account is there in your name.

In the last, “search past statements” and previous history of the credit card lawsuit to get a clue about the debt question.

Debt Collectors Followed the Laws?

After you come to know that you are being sued by a third party, the crucial step you must take into consideration is whether the debt collector or agency is adhering to the rule of Fair Debt Collection Practices Act (FDCPA).

If Applicable, File for Bankruptcy

If you have filed for bankruptcy before and you, after a while, are sued by a debt collector, then it will provide a potential for your credit card lawsuit dismissed. This will halt any way to the collection of debt lawsuits.

So, any post-bankruptcy lawsuit is a violation on behalf of the debt collector. Keep your bankruptcy-served papers to show that the debt comes under bankruptcy protection.

Make sure the judge knows the violation and abuse of the legal process or system to dismiss the lawsuit.

Proper and on-time response

Try not to turn a blind eye to the lawsuit, rather respond properly and in a timely manner, if you know that the debt is legitimate. Ignoring the lawsuit will lead to your ultimate loss.

Raise Affirmative Defenses

Make sure you raise affirmative defenses while answering, besides hiring a consumer lawyer and filing your response via court forum. Affirmative defenses are the “legal arguments or facts you present to defeat the plaintiff.

Examples- Common Affirmative Defenses

“statute of limitation, debt amount discrepancy, improper service, fraud, bankruptcy discharge violation, lack of necessary documentation” are some of the examples of common affirmative defenses.

Rising affirmative defenses would put much pressure on the plaintiff and would make it more difficult for the lawsuit company to win the lawsuit.

Rising affirmative defenses would put much pressure on the plaintiff and would make it more difficult for the lawsuit company to win the lawsuit.

Prove the Case

The burden to provide proof is not upon you but on the creditors. The plaintiff must convince the judge and prove the case as the original creditors suing you must come up with the evidence.

Effectively Negotiate a Debt Settlement

The very first tip one should take into consideration is that you must take the offers in written form. Further, soften your offer so that you could have some room for back and forth movement. Furthermore, do not pay until the agreement is settled in written form.

In addition, after one time debt settlement of payment, wait for the other payment until the lawsuit dismissal confirmation. Moreover, in the end, forward a letter about fully paid debt after paying.

Motion to Dismiss a Claim

If you think that the lawsuit against you has no merit and you have strong evidence against it, then have some aggressive approach for dismissal.

Motion to dismiss for failure to state a claim means that the claim established by the plaintiff is not legal even if it presents the facts fully. For instance, the statute of limitations expired.

Lack of Subject Matter Jurisdiction

This means that the court case hearing the lawsuit has no authority and the case is out of the jurisdiction of the court. For instance, the court was in the wrong venue for this dispute.

Arbitration Clause as ouster of jurisdiction

See if there is a “binding arbitration clause” in your original credit card agreement, you can then use this provision by avoiding the court altogether.

Arbitration is your “private trial” out of the court system. It is the presentation of your case to the arbitrator the judge and the final decision maker.

Most creditors or debt collectors do not like arbitrators, for they have to “cover all fees and costs.” “Some plaintiffs dismiss a debt collection agency lawsuit when faced with a motion to get arbitration from the defendant.

It ruins their return on investment and almost guarantees they will spend more in arbitration costs than they could ever recoup from you.”

So to get this advantage of arbitration, go through your credit card company contract, if it includes an arbitration provision. If it does, you can go for filing a motion besides your answer to the judge for transferring your case to compel arbitration.

Sued by a Debt Collector? What to do

When a debt collector sues, also known as a collection agency, try first to comprehend the process and then respond. Pursue the verification of the debt collector claims and avoid consolidation of the scam.

Typically, after 180 days past due, you will receive a letter or mail through which the debt collector or collection agency will let you know about the debt collection.

Typically, after 180 days past due, you will receive a letter or mail through which the debt collector or collection agency will let you know about the debt collection.

After that, wait for the debt validation letter from the debt collector within 5 days. Through the letter, the debt collector will inform you how much you owe and the ways via which you can dispute the claim.

Complementary Write-up: Suing For Emotional Distress

In the next step, if you are bamboozled about the debt in the letter, ask for a verification letter from the debt collector.

He is bound to send a validation letter within 30 days. After validation, call the debt collector and plan out the payment plan, after being proven that your debt is legitimate.

If you didn’t plan out the payment or didn’t pay the debt collection, they can avail the option of suing you. This process includes receiving complaints followed by court summons.

If you are summoned, respond either by “notice of appearance” or an “answer.” However, pay special attention to the deadline.

However, if you are unable to appear in court or ignore the debt collector or court order, the court will go for your wage garnishing or lien of property. This sort of default judgment usually occurs twenty days after lawsuit service.

Defend the Lawsuit

Knowing the possible options, other than response, at hand will plummet your anxiety and stress. So, it’s important to know some of the options which are: -

Challenge the Lawsuit

When you default on debt, the original creditor avails the services of a third party named a debt collector. Often these agencies sold multiple times incorrect info with troublesome records. However, if you think that the lawsuit is illegitimate, challenge it.

Besides that, the info given by the debt collector is misleading, so file a written response to the lawsuit in court.

Moreover, if you want to dismiss your debt lawsuit, go and consult your law attorney and hire him if needs be. Some attorneys offer free consultation.

Negotiate an Out-of-court Settlement

If you know you owe the unpaid debt, even if it isn’t the full amount, and have the capability to pay something, you might bring to the table an out of court settlement offer.

If you succeed, the lawsuit will be dropped. However, the payment of unpaid debt will be dropped significantly.

Keep in mind that the settlement agreement you carry with the debt collector out of the court will be much easier and inexpensive than the debt settlement within the court. So, the best option is to negotiate with the debt collectors.

Conclusion

Making a case dismissed from the debt collection lawsuit, for instance, means your claim that the lawsuit is not valid and the case, for this reason, should not proceed. how do get a debt lawsuit dismissed?

Try not to turn a blind eye to the lawsuit, rather respond properly and in a timely manner, if you know that the debt is legitimate. Ignoring the lawsuit will lead to your ultimate loss.

See if there is a “binding arbitration clause” in your original credit card agreement, you can then use this provision by avoiding the court altogether. In fact, arbitration is your “private trial” out of the court system.

Frequently Asked Questions

How do I defend my debt from a lawsuit?

Try to respond first as default judgment will go in favor of the creditor. You can either defend yourself by filing for your bankruptcy, counterclaims, if it contains incorrect information, or negotiating out of court settlement.

How do I get my credit card debt lawsuit dismissed?

Validate the debt, respond properly and on time, filing for bankruptcy, raising affirmative defense, and letting the plaintiff prove its case are the ways to make your debt lawsuit dismissed.

What happens if you ignore debt lawsuit?

Respond properly and on time, if you know that the debt is legitimate. Ignoring the lawsuit will lead to default judgment and your ultimate loss.

What happens if a credit card companies sue you and you can’t pay?

The court will go for your wage garnishing or lien of property. This sort of default judgment usually occurs twenty days after lawsuit service.