Many among us have applied for loans in the past which was a form of conventional loans, where the biggest factor credit bureaus consider is your credit score. Few of us are aware that there are other loan options available that consider different factors.

An income based loan is a personal loan that puts more emphasis on your income rather than a minimum credit score. However, your credit scores might affect your loan agreement to get a loan based on monthly gross income.

In this brief guide, we will examine the pros and cons of income based loans and discuss factors that affect your eligibility for the personal loan. This article also addresses the qualifications for loan approval and specifications of income based loans.

Table of Contents

- What is Income-Based Loan?

- How do Income Based Loans work?

- Secured and Unsecured Loans

- Be Cautious of Personal Loan Scams

- How to Apply

- Alternatives to Income-Based Loans

- Where to get Income-Based Loans

- Pros and Cons of Income-Based Loans

- How to Improve Credit using Loans Based on Income?

- What is pawnshop loans and how to get them?

- Loans Based on Employment

- How to get Loans with no Income Verification?

- Conclusion

- Frequently Asked Questions

What is Income-Based Loan?

Income based loans are those which take into consideration different factors than your credit score. Your poor credit score would be a sort of factor that may be considered, however, the primary factor in whether or not you are approved will be your income.

Loans based on income can come with high interest rates and hidden fees which is why understanding how these loans work is significant. If you have a low credit score, then it might affect your eligibility to borrow via a traditional loan.

Related Article: Letter of Hardship

How do Income Based Loans work?

Income based loans work by taking into account different factors to sort out your eligibility for the loan. Hence credit bureaus determine whether or not you qualify for the loan and what terms are you offered on the table.

If you have a good credit history in the past, then you are more likely to be chosen for a higher income based loan. A good credit history plays a significant role in getting large sums of loans with lower interest rates and hidden fees.

If you have a good credit history in the past, then you are more likely to be chosen for a higher income based loan. A good credit history plays a significant role in getting large sums of loans with lower interest rates and hidden fees.

The key thing you need to know is that during the qualification process for a loan, the lender merely focuses on your credit reports and income to determine the terms of the loan. If you have a strong income, then the possibility is that you can get a loan with a soft debt repayment method.

Secured and Unsecured Loans

Besides other personal loans, the common examples of Income based personal loans are; unsecured loan, secured loan, and pawn loan.

Income-based loans as Secured Loans: income-based loans take several forms such as secured loans. If you apply for a secured loan then the lenders will provide you income based loans and require you to submit collateral, such as a car or home.

Collateral is a sort of guarantee which you can take once you repay the loan. However, if you have a bad financial situation and miss timely payments on a secured loan, the lender can take ownership or sell your collateral.

Pawn Loan: another loan that you could expect to get is a pawn loan. A pawn shop loan is a type of loan in which you put an item of value as collateral. This could be jewelry or any other valuable appliance in exchange for the loan.

If you didn’t repay the loan on the given time, the pawn shop loan may take possession of the collateral or sell your collateral to get the money.

Unsecured Loan: you might get unsecured personal loans on applying for loan based income. The significant feature of this kind of loan is that it does not require collateral.

However, this type of loan could be riskier for you because if you cannot repay it on time then it involves the legal system in the process. It might become difficult for you to see the court in this type of loan.

Be Cautious of Personal Loan Scams

If you encounter a lender that does not require any sort of credit inquiry, be cautious because it can be a sign of a personal loan scam. In such cases, the lender guarantees approval, pressures you into the loan.

Like payday loans, you have to do the next day funding, the payday lenders may also try to hide fees for loan amounts or whatever is necessary. These all are signs of loan scam and you need to stay away from such incidents.

How to Apply

If you want to take income based personal loan, then don’t be in a hurry because you need to research lenders’ websites. This will help you identify the lender whose offers you think is best for you.

You will also be able to compare potential offers so you know which lender is offering best rates. You will have to submit bank account statements and proof of your income along with other documents during the application process.

This is a lengthy process which is why we have broken down the process into small steps: -

Compare your Options: if you are really in need of many personal loans and have bad credit records then you will have to look at different peer to peer lenders and their offers.

A potential borrower must compare different options before choosing a regular personal loan. You need to look at different options and determine which lender suits you well in terms of having the fewest fees and the most affordable personal loans.

Prequalify: once you have found a lender, by comparing different options, take the time to submit for prequalification. This will help you know whether or not they are prequalified to apply for the loan.

Keep in mind that this step does not guarantee whether or not you will get a personal loan. It's just an indicator of what will happen to a person’s application.

Submit your Application: after the prequalification step comes the actual work. You need to take the application including the loan amount and submit it along with origination fees for a loan that is based on income purely.

In this step, you may need to submit your personal, financial, and all necessary information such as pay stubs, your SSN, your identification, and your address. Keep in mind that most lenders, nowadays allow for online applications through a secure portal.

You will Receive your Funds: once you submit the application process, the lender will review your application and find out if you are eligible.

You will Receive your Funds: once you submit the application process, the lender will review your application and find out if you are eligible.

Assuming you are approved for the loans based on your paycheck, the lender will fund the loan amount either instantly or within a few days. Once you have the loan amount in your hands you can use it for whatever purpose you want.

Repaying Loan: once your needs are met with the loan and the period of returning the loan comes close then you will need to start repaying the loan amount to the lender.

Alternatives to Income-Based Loans

There are various loans models and alternatives to income based loans which will be discussed here:

Traditional Loans: one of the key alternative to income based loans is by opting for traditional loans. Income based personal loans may have higher interest rate, therefore it would be best choice for you if you apply for a standard personal loan.

The process for standard personal loans is similar to that of income based loans. Standard personal loans, sometimes offer 6%-36% interest rates with low fees. If you have a credit health above 620 then you could get the standard personal loan.

Credit Cards: if you want small loans to fulfill whatever wishes you have. For smaller expenses, you can consider using credit cards.

Credit Cards: if you want small loans to fulfill whatever wishes you have. For smaller expenses, you can consider using credit cards.

In case you have a rewards credit card then you must consider get at least point or dollars back on your purchase.

Loans from Friends or Family: the best payday alternative loan is that we would like you to take is to meet your friends or family and ask for borrowing money. Your friends and family would certainly help you if they found that you are in a terrible situation.

Home Equity Loan: if you have purchased a home then you can consider taking out a special loan that is valued based on the existing equity you have in your home. You can get loans with lower fees and lower interest rates.

Where to get Income-Based Loans

If you are in any state in the United States, then you can apply for income based loan. You can do that by applying online or visiting a nearby traditional bank who are offering loans.

There are various financial institutions that offer income based personal loans. These institutions include:

Online lenders: some online lenders offer income based loans if your personal finance is not good or you have a bad credit history.

Credit unions: it is worth noting that credit unions have more flexible requirements than other lenders. They may be willing to offer a loan based on income rather than credit.

However, the most credit unions out there ask you to become a member to get loans.

Banks: you can also find some traditional banks that offer a loan based on income with less additional fees or interest rates. You can apply for such loan online or by visiting a nearby traditional bank.

Peer to peer lenders: peer-to-peer lenders are the most interesting of all discussed above. This lending platform may connect you with individual investors who may be willing to fund your loan.

Pros and Cons of Income-Based Loans

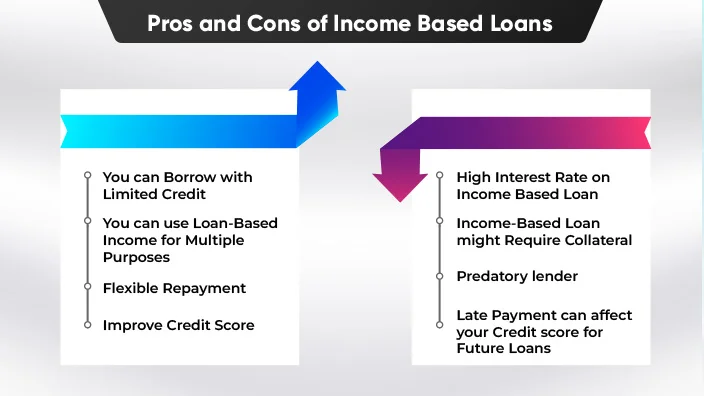

Loans based on income may help you get large sums of money to fulfill your needs. It has benefits as well as downsides.

Pros of Income Based Loans

We will start with some of the notable advantages of income based loan, which are;

You can Borrow with Limited Credit

The first benefit of taking out a loan based on income is the fact that you don’t need to have a high credit score to get it. It helps you to choose among a range of choices the best one that fulfills your needs with less interest and fees.

You can use Loan-Based Income for Multiple Purposes

We have discussed earlier that the majority of income based loans are standard personal loans.

Thus it can be used for whichever purpose a person considers fit. This means that you can use it for home renovation, medical expenses, or other necessary expenses.

Flexible Repayment

Unlike any other type of installment loan, income-based loans offer you a flexible repayment period. You can repay the loan easily by monthly payments. This property makes the income-based loan affordable.

Improve Credit Score

If you take the income based loans and start returning them on time, then it will improve your credit health as well as financial health. The monthly payments are easy and therefore can help improve your credit score. When your credit score is high, you can also borrow from other lenders as well.

Cons of Income Based Loans

Besides its benefits, there are downsides as well:

High Interest Rate on Income Based Loan

Taking out a loan based on income does not require your credit score to be high. It is based on the income that you generate.

Therefore, the lender, in such cases, applies additional fees and high interest rates to the loan. This may cost you additional money management and become a burden on you.

Income-Based Loan might Require Collateral

As we have discussed earlier, the majority of loans are unsecured personal loans, thus requiring collateral. There is no guarantee that you will get unsecured loans.

If your income is lower, then the lender may ask for collateral from you. If you provide collateral, then your application for income based loan might get loan approval.

Predatory Lender

There is also a possibility that you may encounter a predatory lender on the way to get a loan based on income. You may fall to the personal loan scam which could be harmful for you personally and financially.

You can recognize predatory lenders when you notice the lender is offering high interest rates or additional fees.

Late Payment can affect your Credit score for Future Loans

Loan based on income may help you solve your immediate problems such as getting rid of medical expenses and home renovation. But it also comes at a cost. A loan based on income has the potential to impact your credit score negatively.

If you are unable to repay the loan on time, your credit score will be affected badly. It could lead to trouble in the future when it comes to borrowing funds.

How to Improve Credit using Loans Based on Income?

If you are in need and approved for a loan based on income. With its potential downsides, you can still use it to bolster your credit score.

There are two major ways to build credit: -

Pay on time

The first thing you need to do is make monthly payments on time because timely repayment will enable you to build your credit. You need to set a reminder for a monthly payment so that you can benefit from a loan based on income.

Another form of credit

Income-based loan is a different type of loan that will help to bolster your credit score. The credit mix person is one of the factors used to calculate credit scores. If they calculate that your score is high they will, certainly, make you eligible for other loans.

What is pawnshop loans and how to get them?

After all this discussion, if you think that personal loan based on income or traditional loans may not cover long term interest costs. You might require immediate cash right away.

If you have an emergency and want cash, then the good option is to pawn personal items you can live without for a time at a local pawnshop. Pawning can work like a loan.

The loans are secured by property or something like that. However, the pawnshop works differently than other loans. It can take the physical possession of the item until the loan is repaid or your terms end.

Keep in mind that pawnshop is highly regulated by the state. For instance: -

Alaska: Pawnshop in Alaska is limited to transactions of about $750 or less. The maximum amount of interest and fee that they charge is 20% of the amount financed per 30-day period, also their debt to income ratio is less.

Loans Based on Employment

Can I take loan based on my salary? If you don’t qualify for loan terms for income based loans, then you have other options that you may like to explore such as loans based on employment. An employee loan is provided by an employer.

Keep in mind that these types of loans aren’t offered by every employer. However, every employer or company differ widely in terms of eligibility requirements and other specifics.

Generally, the key feature of loan based on employment is that it has lower interest rates than other types of loans like fund loans, rocket loans, Payday loans. In case, your company or employer does not offer employee loans then you might want to explore other options.

How to get Loans with no Income Verification?

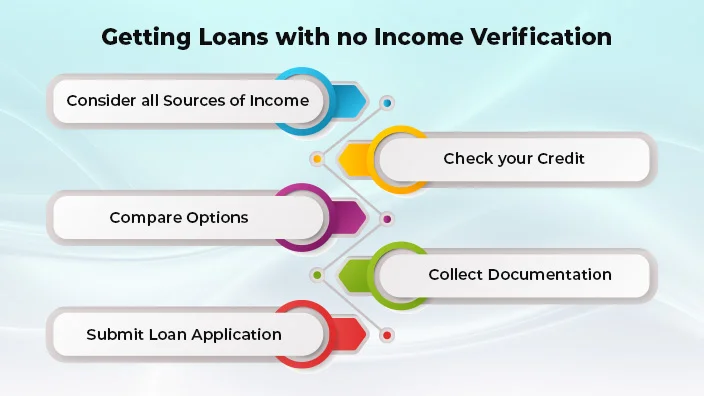

If you have no verification of your income, you can still get loan by following these steps: -

Consider all Sources of Income: when you apply for loans they ask for a source or verification of income. If you are not employed, there may be other sources of income that can help you qualify for a personal loan.

Consider all Sources of Income: when you apply for loans they ask for a source or verification of income. If you are not employed, there may be other sources of income that can help you qualify for a personal loan.

Social security benefits, side gigs, alimony, and worker’s compensation payments may all be included as income on your loan application.

Check your Credit: in case you don’t have any income, then you need to make your credit score high and attractive. Major credit bureaus will look into the credit score which can help you in getting loans. The three major credit bureaus are; Equifax, TransUnion, and Experian.

Compare Options: next in the process you have to check all the available options and see if you can qualify for a loan. You may qualify for unsecured personal loans.

Collect Documentation: in case you find out that you can get secured loan then you will have to provide all the necessary personal and financial information.

Submit Loan Application: you have completed the application and is ready to be submitted. Some lenders have opened online portals for loans application so make sure you have submitted the application.

Conclusion

If you are facing financial issues and apply for a traditional personal loan, then most probably the lender will look into your income and credit history to determine your eligibility and loan terms. God forbids, if you have a bad credit history, you may not qualify for a loan that is based on income.

If you have a reliable income with credit checks, you can apply for income-based loans which have usually low interest rates and fewer fees. It is essential to know that there are other options that you can explore but be very careful of predatory lenders.

If you have a steady monthly income and annual income with good credit history then we advise you to apply for income-based loans. In this brief guide, we have discussed the ins and outs of taking loans based on income or employment.

Frequently Asked Questions

Are personal loans based on income?

You can get some types of personal loans which are based on income. However, some lenders require you to submit verification of your income.

Can I get a loan on a fixed income?

Yes, you can apply and get a loan if you have a fixed income. while getting a loan on a fixed income, they consider; social security, or health benefits, and other factors.

What is an income loan?

You can get an income loan if you have a good credit score. It can be used for multiple purposes such as medical expenses, mortgages, or utility bills.