Facing a lawsuit in court, if the court issues a judgment against the defendant to pay you the debt or liability. Though it is a legal obligation on the defendant, yet it is uncertain whether the defendant will pay it or not.

So, if you find yourself in a situation where you win a lawsuit, but the defendant doesn’t pay the judgment. what happens if a defendant does not pay a judgment becomes relevant to thrash out.

what are the possible ways and strategies through which you can get your gains or collect your judgment?

Before you sue, ask yourself whether you would be able to collect. The article studies the issues of collecting judgment and other ways of recovering money.

Table of Contents

- What a Judgment Means for You

- Finding a Judgment Debtor's Property

- Protecting Judgments with Liens

- Liens Often Remain After Bankruptcy

- Bankruptcy and Judgment Collection

- Benefits of Offering Credit After Bankruptcy

- Other Judgment Collection Options

- What Happens If a Defendant Refuses Paying a Judgment

- Renewing the Judgment

- Conclusion

- Frequently Asked Questions

What a Judgment Means for You

Before finding the ways to solidify the judgment, first, try to find out and go through the judgment. The judgment is usually the sum of the amount owed plus interest.

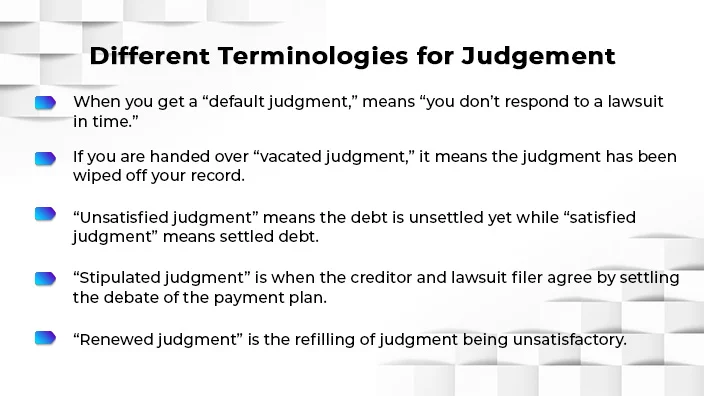

The vocabulary you will see near the term “judgment” will help you get away with the confusion.

The vocabulary you will see near the term “judgment” will help you get away with the confusion.

Finding a Judgment Debtor's Property

If you are a busy person having no time to file your lawsuit, don’t give up. Give it a go as the court will mostly ask the defendant to answer questions about their business assets and other financial issues.

You will come to know that the defendant owns assets and financial documents via questionnaire and examination through the procedure set by the court.

You can, then, go for “seizing and selling” the defendant’s property, for instance vehicle or house, to get your judgment.

For instance, if Smith refused to pay the court judgment proof to Henry after he won the case, Henry file a case for “debtor’s examination”.

After Henry reviews the financial status and assets of Smith and the items he owns, Henry can easily settle the debt with him.

Suggested Reading: How to Get a Debt Lawsuit Dismissed

Protecting Judgments with Liens

If the judgment of the judge favors you and you have the judgment, you should carry the judgment into the “recorder’s office” in order to put a lien upon the defendant’s property.

Now, if any time soon the defendant wants to “sell the real property” you will get your judgment before the real property gets transferred to the new owner.

Now, if any time soon the defendant wants to “sell the real property” you will get your judgment before the real property gets transferred to the new owner.

Besides that, if, in any case, the debtor gets bankrupt and files for bankruptcy, you can have an upper hand there and can put liens against that property while filing with the State Secretary.

For instance, if Henry won a judgment of a large amount against Smith, he could go for filing judgment with the record of where Smith owned a property.

Later, whenever Smith sells his house, Henry can receive his money from the judgment.

Liens Often Remain After Bankruptcy

If the judgment for the lien is put forward before the bankruptcy is filed, the debtor files can’t escape the hot water. The reason is that with bankruptcy the lien doesn’t come to an end by itself.

The “lienholder” can get the “liend property” until the lien is thereafter bankruptcy.

Henry won a $200,000 state court judge judgment against Smith, and Smith “filed for bankruptcy five days later”. Frank thought he could remove the judgment by a swift move of filing quickly.

However, Henry “recorded a lien against Smith's home the day after receiving the judgment” before Smith filed for bankruptcy.

However, Henry “recorded a lien against Smith's home the day after receiving the judgment” before Smith filed for bankruptcy.

Smith could request the court to “remove the lien”, but the court will only remove it to the extent that it “impairs Smith’s homestead exemption” or up to $100,000.

Smith could have avoided the lien by filing for bankruptcy before Henry received a judgment and recorded it against Smith’s home.

So, as the case shows, if you are announcing your bankruptcy after the judgment has been received by the other party, you are late then. You should submit your bankruptcy before the arrival of the final judgment.

Bankruptcy and Judgment Collection

As mentioned, you can protect your judgment via liens but it’s not that much of an easy task in practice.

Collection efforts like collecting your judgment and collection process aren’t always easy in situations where the company has already filed for bankruptcy.

For example, your judgment will be rescinded or removed for credit card debt, not text debt, in case of one’s bankruptcy. So, some judgments are non-dischargeable in bankruptcy.

Some debt types are categorized as non-dischargeable without any further process, if they just fall into these categories.

Until shown some extraordinary or obnoxious circumstances, some debts aren’t dischargeable.

For instance, “unscheduled debts, debts for spousal support or alimony, owe money or debt to ex-spouse or child rose in separation or for past due child support, debts or money to government agencies for penalties, student loans and many more are non-dischargeable debts.”

For instance, “unscheduled debts, debts for spousal support or alimony, owe money or debt to ex-spouse or child rose in separation or for past due child support, debts or money to government agencies for penalties, student loans and many more are non-dischargeable debts.”

However, there are some exceptions to these. The court date must declare the judgment debt as non-dischargeable after the request of the creditor if it seems a fraud judgment.

However, Henry struggled and requested the bankruptcy judge through a bankruptcy lawyer to declare the fraud judgment as non-dischargeable.

The court judge accepted the request and granted Henry the judgment by pointing Smith out as responsible for paying a $50,000 judgment.

Benefits of Offering Credit After Bankruptcy

Many people won’t get into business deals with you if you have been bankrupted recently. The reason is that they consider you as unreliable as you were unable to pay your debt in the recent bankruptcy.

People who declared themselves bankrupt are mostly employed. This is a sort of loophole that leaves some place for garnishing of the bankrupt bank accounts.

In addition, once one declares oneself bankrupt, one has to wait for several years before declaring oneself bankrupt again.

Thus, if one is unable to pay voluntarily the debt, the lawsuit filer, in this scenario, could have a lot of time to sue.

You, then, can collect your new debt without having the fear that the judgment debtor will remove the filing via bankruptcy.

By bringing Henry and Smith, we can assume another scenario. For instance, Smith’s property, like a car or house, is damaged and is beyond repair, after a year of bankruptcy.

By bringing Henry and Smith, we can assume another scenario. For instance, Smith’s property, like a car or house, is damaged and is beyond repair, after a year of bankruptcy.

He is unable to afford the finances or a new car and went to the local dealer who deals with people having recent bankruptcies.

The local dealer bestowed Smith with finances. The reason he is doing it is because Smith is a reasonable risk and he won’t be able to file another for the next few years.

Your state, through court order, can bestow you with other strategies to collect your judgment.

Wage Garnishment

The most common method to collect the judgment is through wage garnishment, in which a specific portion of the wages of the defendant will be steered to you until the whole judgment is paid off.

This method requires a court date or order. In this process, you will be given a copy of an “Earnings Withholding Order” in order to garnish the judgment creditor some portion of your money.

However, the limit set on the judgment creditor is, generally, 25% because the judgment creditor can’t be given the free hand to take away the collector car and money you need to support yourself and your family.

The options you can avail in case of the judgment creditor garnishing you. First, go and see a lawyer. Then, try to resolve the issue by yourself with the judgment creditor by agreeing with the creditor.

The options you can avail in case of the judgment creditor garnishing you. First, go and see a lawyer. Then, try to resolve the issue by yourself with the judgment creditor by agreeing with the creditor.

In the last, ask for a “claim of exemption”. The process to ask for a “claim of exemption for wage garnishment” can be started as soon as you get your certified copy of the order.

Fill out the “claim of exemption” after consultation with a lawyer.

Keep one copy with yourself while mailing the original one, besides one photo copy, of the “claim of exemption plus financial statement” to the city Marshal.

Wait for 10 days and see if the judgment creditor opposes your claim.

If the doesn’t, Marshal will tell your employer not to order the money owed withdrawn.

If he does oppose, after receiving notice the court will set a date to decide and the judge will make a decision on the court hearing day.

Bank Levies

You can pursue the court hearing via your attorney and get the orders for seizing funds from the defendant’s bank accounts.

After freezing the defendant’s accounts, you will withdraw funds until the amount of judgment is completed.

Suspending Driving Privileges

If your judgment stems from an auto accident, you can suspend, in many states, the debtor's driver’s license via the Department of Motor Vehicles.

However, the judgment debtor can decide bankruptcy in order to get rid of the debt and suspension. In such a case, negotiate with the debtor and work out a payment plan.

Revoking Professional Licenses

In some states like California, you can file the judgment with “the state licensing board”, if you have filed a lawsuit against a contractor or building.

File for bankruptcy and they will lose the license, if they don’t pay the judgment off.

Ordering Installment Plans

It’s upon you whether you want to pay the judgment in installments or by setting a payment plan up. For this, try to negotiate with the judgment creditor and see if that works well with the payment plan of the creditor.

Constantly remind the judgment creditor that will pay the judgment money but it won’t be possible to pay it all at once.

If this works out well, make sure all of the agreements are in writing. It must encompass dates, interest and its amount, form of payment, and the person to whom the payment should be made.

If this works out well, make sure all of the agreements are in writing. It must encompass dates, interest and its amount, form of payment, and the person to whom the payment should be made.

Another way to get your judgment is by getting the help of the court. In this case, the court might order the defendant to pay the judgment directly in installments to the court. This service is mostly provided by small claims court.

Property You Can’t Collect

If you think you can collect any sort of personal property of the debtor on which you put your finger, you are wrong. In fact, Debtor Protection laws keep some of the personal property types, like food on the debtor’s table, clothing, TV, and many more, from selling after the debtor fails.

In many states, you can’t even sell the collector car or car of a debtor because most of these states protect the debtor’s vehicle from creditors.

However, certain protected equity amounts be increased in case the vehicle is being used for business.

You, unluckily, will find yourself in hot waters when being the defendant, if he doesn’t pay the creditor’s judgment.

Judgment is, in essence, permission by the court to take the money willingly from you, even if you don’t want to.

What happens if a defendant doesn’t pay a judgment, or submit the judgment then the court, on the request of the judgment creditor, can give a free hand to the enforcement officers like the Sheriff or City Marshal, to seize your property and sell it.

Then, if sounds invasive and obnoxious but is a legal process, then, could auction your property.

Further, the creditor also has the only option of putting you in jail. In case you choose the prison, you, as the ill luck would have it, will stay there until and unless you pay the creditor’s judgment.

Further, the creditor also has the only option of putting you in jail. In case you choose the prison, you, as the ill luck would have it, will stay there until and unless you pay the creditor’s judgment.

Furthermore, if you don’t pay the judgment, it will add interest to your judgment, whether you are willing or not. Just imagine the amount of accrued interest over eighteen to twenty years, as the judgment case could be active up to this period.

Moreover, besides the bankruptcy and liens on your record, you will end up with another black dot on your credit report card.

These will deeply impact your credit score and people would not be open hearted to lend you a slump of money.

To sum things up, you need to take it seriously that what happens if a defendant doesn’t pay a judgment, would be something most damaging to you and your credit report and many more things.

Renewing the Judgment

Let’s assume a case where the person of judgment doesn’t own anything. So, you can hitherto only seize with a money judgment. Most people’s financial status improves with time except old retired and disabled people.

As judgment period is mostly seven to twenty years, depending on the state, but, if you were unable to collect the judgment in that particular period, most states allow the extension judgment period and renewal of judgment.

Depending on the time period of renewal that varies from state to state, for instance, Alaska 10 and Alabama 20, not only renewed judgments are valid interests also add up to them.

Depending on the time period of renewal that varies from state to state, for instance, Alaska 10 and Alabama 20, not only renewed judgments are valid interests also add up to them.

For instance, Smith, now the owner of a house and other properties, was once a college student. He had a judgment of $5000 from a credit card creditor, back then, that he forgot about.

After many years of graduating from school and securing a highly paid job, he now owns some property. Difficulties arrive when one day he receives a call from a “debt collector” who has had Smith's judgment purchased by the new owner.

He came to know that the judgment balance accrued interest amounted to a huge amount of $30,000. Now, the collector plans to seize his property or house. He has to decide now whether to pay the old debts or lose his house.

Conclusion

It has been concluded that even if you are successful in getting a judge in your favour from the court of law against the defendant but he is still adamant to not give you what belongs to you; so what steps you should take.

If it is requested the court to get the judgement be executed for the recovery purposes; the court can pass directions by giving free hand to the enforcement bodies i.e. sheriffs or city marshals to find out the property of the judgement debtor, seize that and proceed for selling the same in order to compensate the judgement creditor.

Moreover, besides the bankruptcy and liens on your record, you will end up with another black dot on your credit report card.

These will deeply impact your credit score and people would not be open hearted to lend you a slump of money.

Frequently Asked Questions

If you do not pay the creditor, the creditor can persuade the court to put you behind bars under section 5250 of the New York “Civil Practice Law and Rules”.

If the defendant is unable to pay the money, the court can issue an order to the Marshal to collect the court order and put the person behind bars in Texas.

If you fail to appear on the court’s order in the court to the hearing and don’t pay the court costs, the court in California can issue your warrant to be arrested.